cap and trade system vs carbon tax

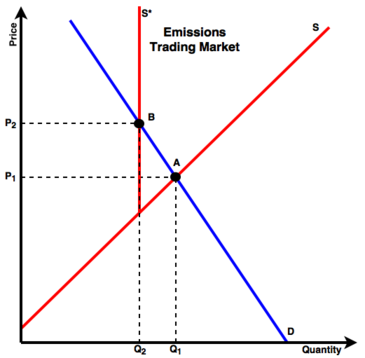

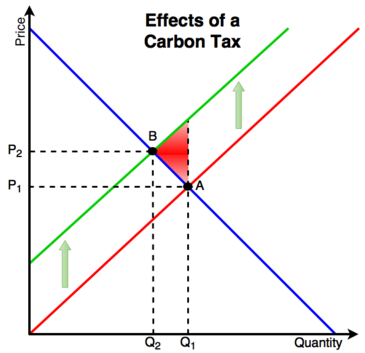

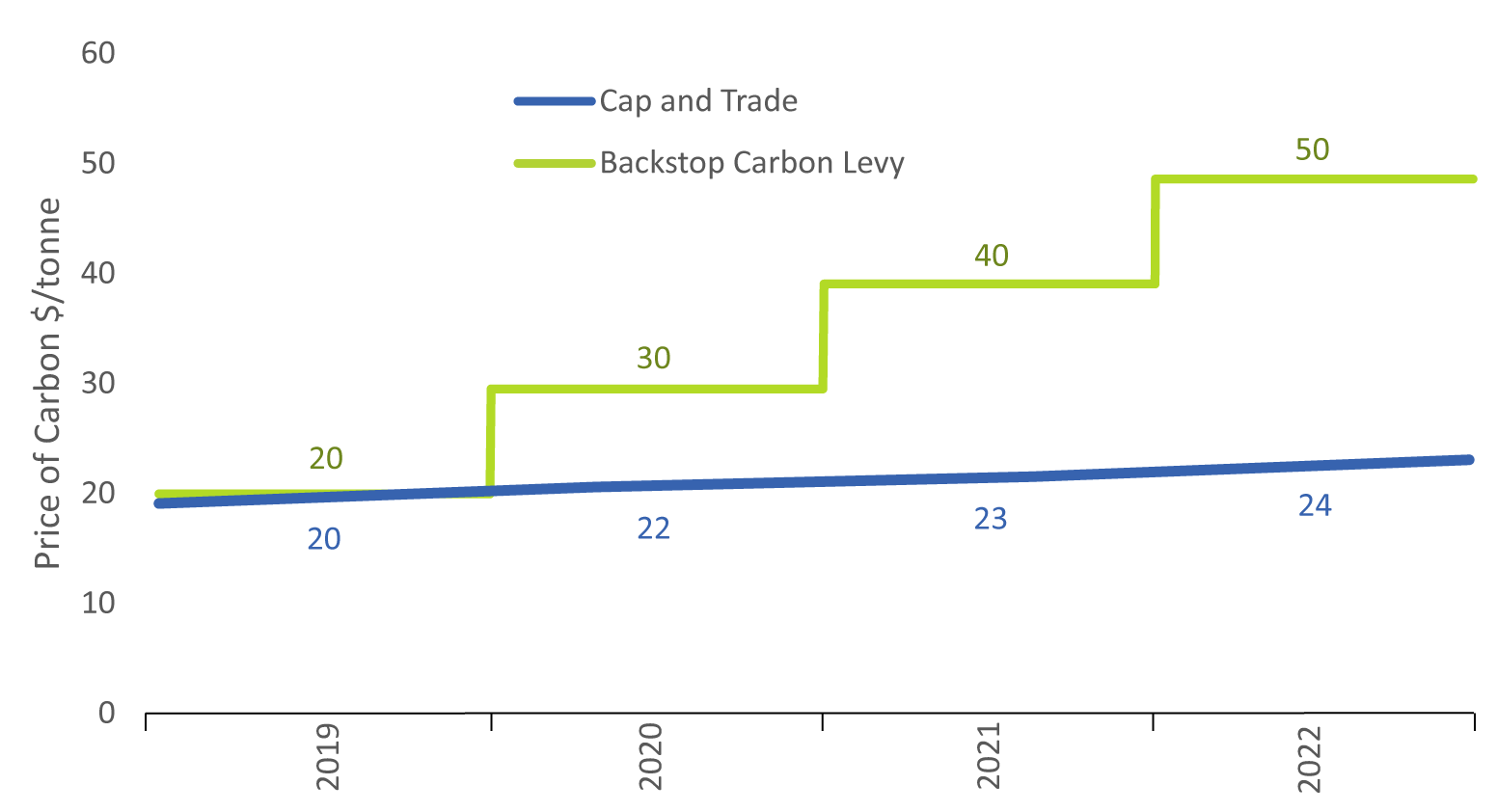

While a carbon tax sets the price of CO2 emissions and allows the market to determine the amount of reduced emissions a cap-and-trade system sets the quantity of emissions allowed which can then be used to estimate the decline in the rise of global temperatures. Carbon taxes and cap-and-trade schemes both add to the price of emitting CO2 albeit in slightly different ways.

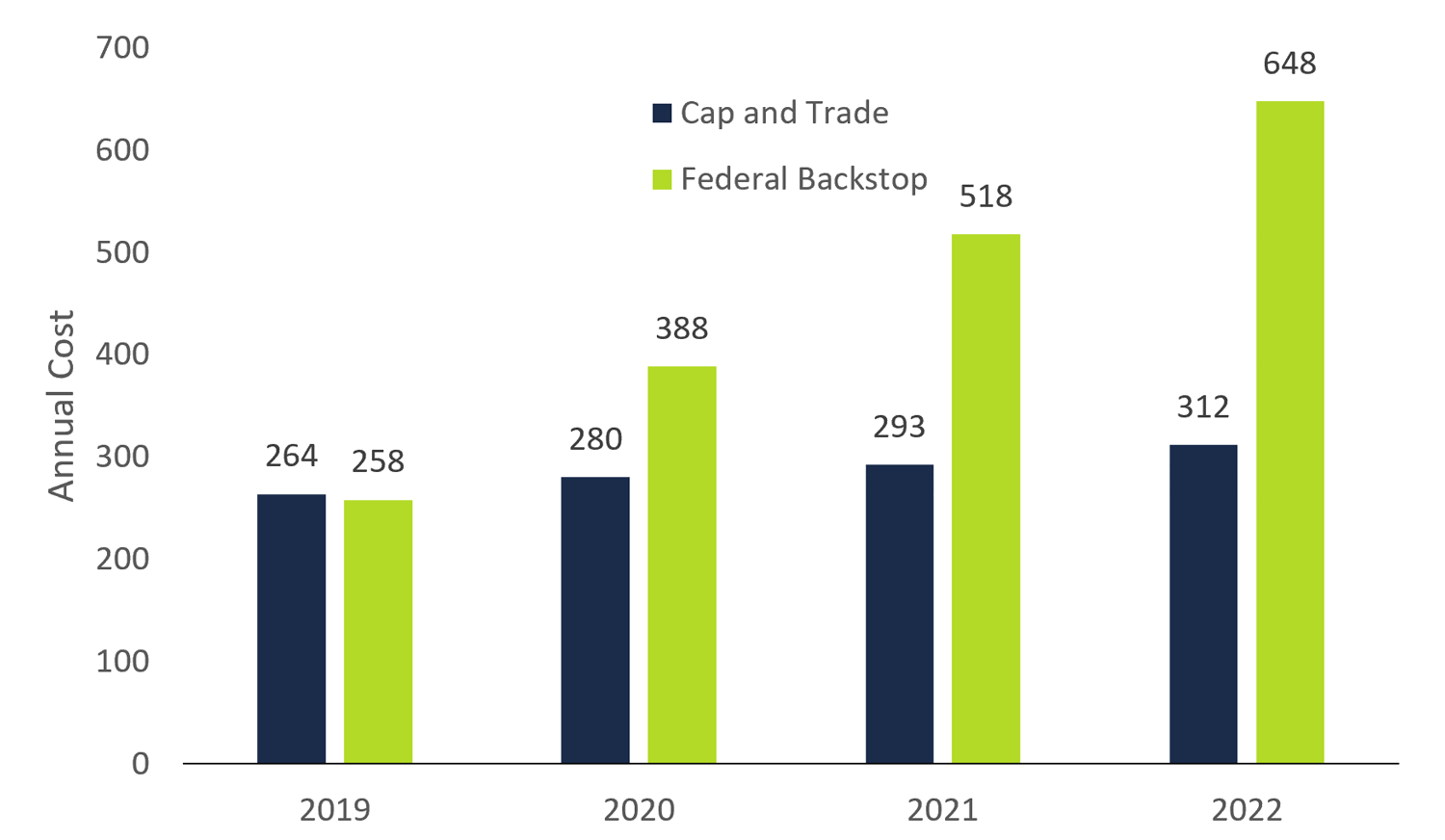

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

The cap aspect is where a government sets an emission cap and issues a.

. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. Cap-and-Trade systems limit the amount of carbon dioxide that gets emitted but gives little control to the price.

A Critical Review Lawrence H. On the other hand political economy forces strongly point to less severe tar - gets if carbon taxes are used rather than cap-and-trade which is why envi-ronmental NGOs are opposed to the tax approach. Here is the Econ 101 version of how the two work.

The cap and trade system is thus functionally similar to a tax on carbon. Goulder and Andrew Schein NBER Working Paper No. -Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax discourages carbon emissions but cannot limit them to quantifiable annual levels-A Carbon Tax is based almost exclusively around the nation-state level.

11 Price and Quantity. A carbon tax imposes a tax on each unit of greenhouse gas emissions and gives firms and households depending on the scope an incentive to reduce pollution whenever doing so would cost less than. You can do the same to cap-and-trade.

To a first approximation cap-and trade is the equivalent of a carbon tax. Issue Date August 2013. I have grave doubts that international agreements imposing a globalized so-called cap-and-trade system on CO2 emissions will prove feasible he wrote in his recent book The Age of.

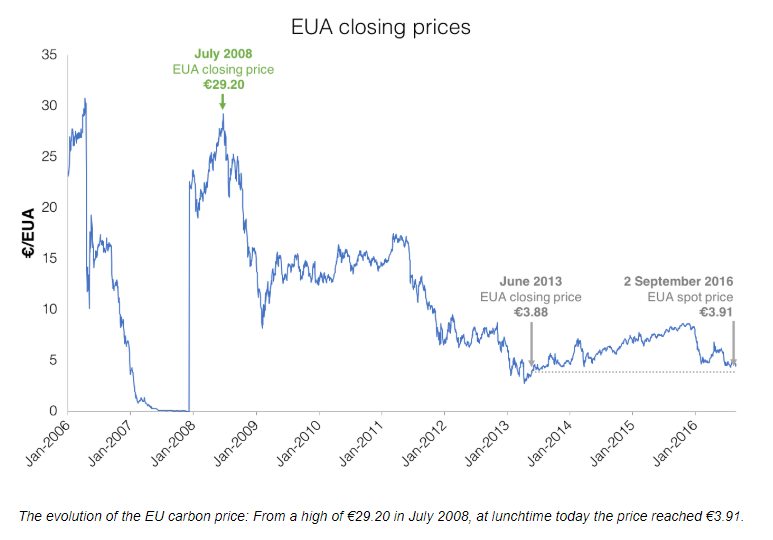

Peter MacdiarmidGetty Images G r. Indeed in stable world with perfect information cap and trade would be exactly equivalent to a. Under a cap-and-trade system reduced economic growth would lower allowance prices.

With a tax you get certainty about prices but uncertainty about emission reductions. Carbon Tax vs. November 2019 Paper There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy-wide carbon-pricing system will be an essential element of any national policy that can achieve meaningful reductions of CO2 emissions costeffectively in the United States and many other countries.

Changes in economic activity impact a firms behavior under either system. 19338 August 2013 JEL No. If the European Unions Emission Trading Scheme ETS accomplishes.

Under a tax government action to lower the amount of the tax not market forces would be required to reduce the carbon price seen by firms. We show that the various options are equivalent along. We show that the various options are equivalent along more dimensions than often are recognized.

Economic guru and former Federal Reserve Chairman Alan Greenspan has come out against cap and trade as an effective mechanism for reducing carbon emissions. Before the policy the intersection of the supply and demand curves for. The cap typically decreases each year to cut down the total.

In times of economic expansion the. Both can be weakened with loopholes and favors for special interests. A carbon tax and cap-and-trade are opposite sides of the same coin.

A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they producewhereas a. Stavins Harvard Kennedy School abstract There is widespread agreement among economists and a diverse set of other policy analysts that at least in the long run an economy-wide carbon-pricing system will be an essential. Theory and practice Robert N.

For firm A the 3 tax is less than the 4 cost to reduce so A pays the tax and does not reduce emissions. With a cap you get the inverse. Political reality being what it is either is likely to impose a fairly low.

For firm B the 3 tax is more than the 2 cost to reduce so B pays no tax and eliminates emissions. 1 Effects of Emissions Trading and a Carbon Tax. No matter how much gets emitted a carbon tax makes the emission the same.

Under a cap-and-trade system governments impose a strict quota or cap on the overall level of carbon pollution that can be generated. A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism. Carbon taxes vs.

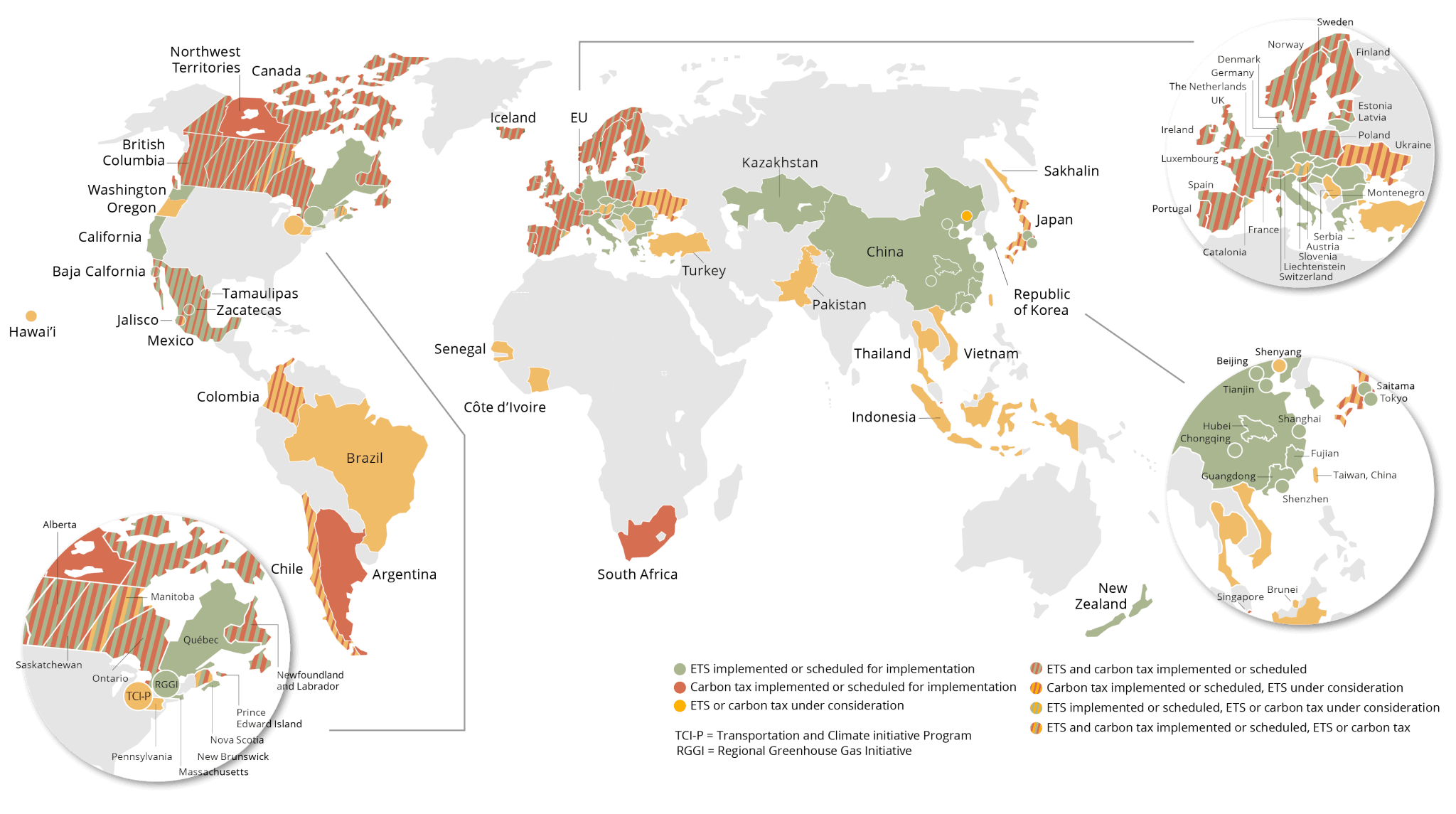

You can tweak a tax to shift the balance. A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system. A cap-and-trade system and a carbon tax -- the best and most likely approach for the short to medium term in the United States is a cap-and.

We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor. Government sets a tax of 3 per ton of emissions. Carbon taxes makes emitting carbon dioxide more expensive.

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. An economy-wide upstream cap-and-trade system on the carbon content of fossil fuels can cover all fossil-fuel-related CO2 emissions without needing to regulate each emissions source individually. H23Q50Q54 ABSTRACT We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price floor.

Cap and Trade.

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

Economist S View Carbon Taxes Vs Cap And Trade

Carbon Tax Vs Emissions Trading Energy Education

How To Design Carbon Taxes The Economist

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Carbon Markets Putting A Price On Carbon Green City Times

Carbon Tax Vs Emissions Trading Energy Education

Carbon Pricing Is Here To Stay In Canada What Is It Anyway Youtube

Carbon Tax Versus Cap And Trade

Cap And Trade An Overview Sciencedirect Topics

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

Cap And Trade Basics Center For Climate And Energy Solutions